Preface

Operating with a truly global footprint, Campden Wealth has a long history of distributing knowledge, intelligence and news to a community of the world’s leading families, their family offices and ultra-high net worth investors. I recently shared my thoughts on how families and family offices are searching for new investment models that better align their return profiles with their value sets. The article analyzes how family offices are leveraging their competitive advantages over institutional investors for superior investment opportunities and how many family offices are fortifying their strategic alliances with other family offices.

Families and family offices are searching for new investment models that better align their return profiles with their value sets. Increasingly, family offices are seeking to leverage the multiple material competitive advantages they hold over institutional investors for superior investment opportunities. Many family offices are fortifying their strategic alliances with other family offices, cross-leveraging their respective skillsets and unlocking greater collective value.

Where does it lead? And what does the future hold for families co-investing in family-only investment vehicles? This article overviews a new investment model at the intersection of families, capital and prosperity.

FAMILIES

Family businesses form the backbone of the world economy and, by proxy, constitute a large potential investment landscape. The 24 million+ family businesses in the United States employ 62% of the workforce, contribute 64% of the GDP and create 78% of the new jobs. In many parts of the world, family businesses play an even larger role than in the United States. Family businesses are not limited to small companies. Family-controlled enterprises include sprawling corporations such as Walmart, Samsung, and Tata Group that, according to Boston Consulting Group, account for more than 30% of all companies with sales over $1 billion.

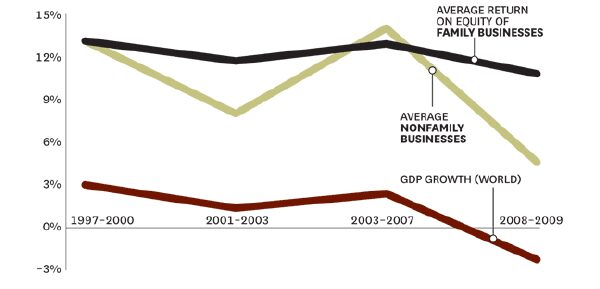

Data also supports the assertion that family firms often perform better than non-family firms. The Harvard Business Review analyzed business cycles from 1997 to 2009, saying: “Though family-run companies slightly lag their peer group when the economy booms, they weather recessions far better.” This flows from family firms being more frugal, carrying less debt, being more diversified than many realize, being more international and retaining talent better than their competitors. This data argues that family offices investing in private companies should be specifically targeting family-businesses in recessionary times.

The Long-Term View of Family-Business Performance

Source: Harvard Business Review

Given the confluence of a vast investment landscape of family businesses, coupled with the relative outperformance in difficult financial times of family firms over non-family firms, one would surmise that family offices would prioritise investment in family firms. Yet very few investment funds are solely focused on family businesses; even fewer seek to leverage the idiosyncratic competitive advantages that family offices hold to unlock value in family firms. With much of their limited partnership (LP) commitments coming from pension funds, fund-of-funds and other institutional investors (rather than family offices), most private investment funds are not specifically tailored to partner with family firms.

CAPITAL

Most investors view capital as one-dimensional: money invested with the expectation of a financial return by a targeted date. Families, however, can redefine Capital as: Intellectual Capital, Relational Capital and Patient Financial Capital.

Intellectual Capital is comprised of the industry know-how that many investing families have developed, sometimes over generations. This could be in the form of strategic insights in supply chain management, manufacturing efficiencies or procurement practices. This Intellectual Capital can materially differentiate a family office investor from an institutional or purely financial investor in terms of potential value-add to an investee company.

Relational Capital represents the relationships and goodwill that an investing family office can add to an investee company. This might take the form of a strategic introduction to a potential board member, strategic supplier or major customer. It might involve improving an investee company’s chances of winning a competitive bid based on the goodwill associated with a family office LP.

Patient Financial Capital connotes the differentiated longer-term mindset that many family offices have to private investment. Many families craft their investment strategies for multi-generational wealth creation rather than short-term return requirements. This differentiates family offices from other investors – particularly as it relates to investments in family firms that hold a similar multi-generational view of value creation.

Capital provides families a competitive advantage over non-family investors. This competitive advantage can be magnified when multiple families, spanning different industries and geographies, cross-leverage their Capital for superior investment sourcing and greater post-investment value add.

PROSPERITY

The etymology of the verb “prosper” hails from Old French (14th-Century) “prosperen” meaning “Be successful, thrive, advance in any good thing.” The Latin “prosperare” means “Cause to succeed, render happy.” The word also connotes lasting and enduring wealth – not necessarily short-term success that evaporates.

Increasingly, families are investing not only for desired financial returns but also for alignment with their value sets. While families’ value sets differ, many target prosperity, either expressly or implicitly. This may take the form of specific “Impact” targets, investing for job creation, investing in emerging or frontier markets, or investing in disruptive industries that are poised to bring positive societal change. Families’ focus on prosperity as a component of their investment decisions is set to increase in decades to come.

AN EXAMPLE: THREE-DIMENSIONAL CAPITAL IN SUB-SAHARAN AFRICA

Private equity fund 1K Africa is an example of a family-only investment fund that leverages families’ Capital for increased prosperity in Africa. Founded on the principle that free enterprise holds the power to create jobs that can uplift a continent, the fund’s portfolio companies have created or sustained more than 7,600 jobs and contributed to the financial well-being of over 30,000 individuals.

One of the fund’s investments is in a remarkable fintech company based in South Africa: Paymenow. Many in Africa live paycheck to paycheck. With no bank accounts and no access to credit (other than informal lenders who often charge exorbitant interest rates), the only source of income is salary. In South Africa, approximately 50% of workers seek informal loans between their payout days. Only one out of ten have cash left after paying bills. Paymenow provides an alternative to expensive payday lenders through affordable, real-time access to earned wages. With proprietary algorithms underpinning its IP backbone, Paymenow promotes financial education through gamification modules directly on its app to encourage savings and responsible use of the service. Benefits to employers include increased staff retention, engagement and productivity including a reduction in absenteeism, theft and fraud.

1K Africa won its investment in Paymenow directly as a result of the Capital that its family-only investment base offers. The remarkable growth of this company, coupled with its catalytic impact across Africa, demonstrates how families, capital and prosperity can coalesce into a new private investment model.

Follow Hendrik Jordaan on Twitter and LinkedIn.

DISCLAIMER: The opinions and views expressed herein are solely those of the author and do not necessarily represent the view(s) of any affiliated institution or organization including without limitation 1K Africa, Family Legacy Capital Credit Management, LLC, Family Legacy Capital Management, LLC, and any investment fund, entity or vehicle managed by or affiliated or associated with any of them.

Original article published on 30 AUGUST, 2022 : CampdenFB.com by Hendrik Jordaan